By admin on 4 May 2022

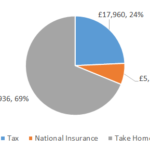

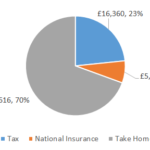

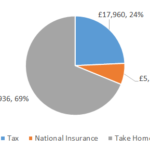

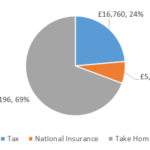

For the 2022 / 2023 tax year £74,000 after tax is £50,845 annually and it makes £4,237 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £74,000.00 […]

Posted in Uncategorized

By admin on 4 May 2022

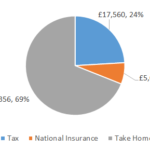

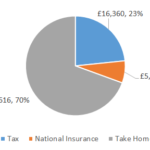

For the 2022 / 2023 tax year £73,000 after tax is £50,278 annually and it makes £4,190 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £73,000.00 […]

Posted in Uncategorized

By admin on 4 May 2022

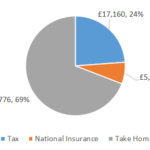

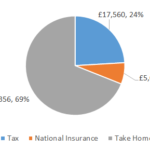

For the 2022 / 2023 tax year £72,000 after tax is £49,710 annually and it makes £4,143 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £72,000.00 […]

Posted in Uncategorized

By admin on 4 May 2022

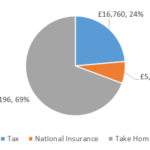

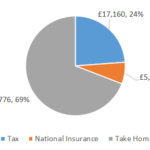

For the 2022 / 2023 tax year £71,000 after tax is £49,143 annually and it makes £4,095 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £71,000.00 […]

Posted in Uncategorized

By admin on 4 May 2022

For the 2022 / 2023 tax year £70,000 after tax is £48,575 annually and it makes £4,048 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £70,000.00 […]

Posted in Uncategorized

By admin on 3 May 2022

Why Use an Up-to-Date Net Salary Calculator? Using a net salary calculator can assist you in determining, realistically, how much you will be making each and every month, after taxes and national contributions, among other deductions. These tools are quick and easy to use, but you need to keep in mind that you should be […]

Posted in Uncategorized

By admin on 3 May 2022

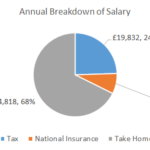

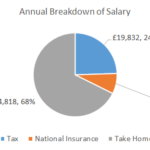

For the 2022 / 2023 tax year £81,000 after tax is £54,818 annually and it makes £4,568 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income […]

Posted in Uncategorized

By admin on 3 May 2022

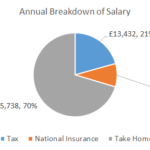

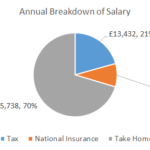

For the 2022 / 2023 tax year £65,000 after tax is £45,738 annually and it makes £3,811 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income […]

Posted in Uncategorized

By admin on 3 May 2022

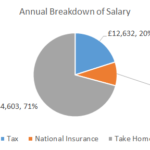

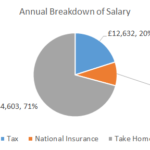

For the 2022 / 2023 tax year £63,000 after tax is £44,603 annually and it makes £3,717 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income […]

Posted in Uncategorized

By admin on 3 May 2022

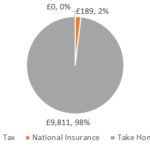

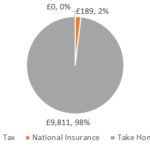

For the 2022 / 2023 tax year £10,000 After Tax is £9,984 annually and makes £832 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £10,000.00 £833.33 […]

Posted in Uncategorized