By admin on 11 July 2019

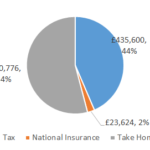

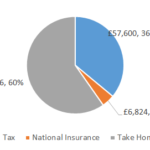

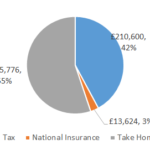

For the 2019 / 2020 tax year £1,000,000 After Tax is £541,036 annually and makes £45,086 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £1,000,000.00 £83,333.33 £19,230.77 £3,846.15 […]

Posted in Uncategorized

By admin on 11 July 2019

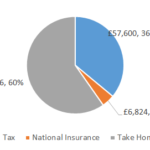

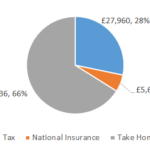

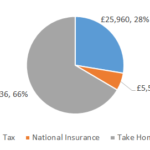

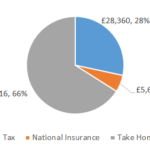

For the 2019/2020 tax year £160,000 gross salary after tax (net) is £95,836 annually and it makes £7,986 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income […]

Posted in Uncategorized

By admin on 11 July 2019

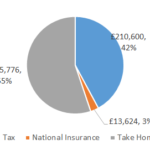

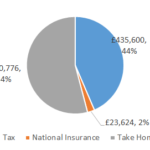

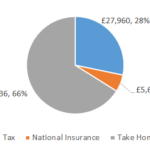

For the 2019 / 2020 tax year £500,000 After Tax is £276,036 annually and makes £23,003 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £500,000.00 £41,666.67 £9,615.38 £1,923.08 Pension Deductions […]

Posted in Uncategorized

By admin on 1 July 2019

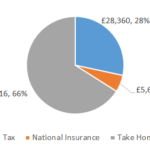

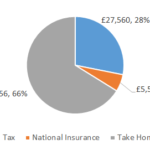

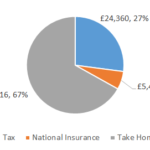

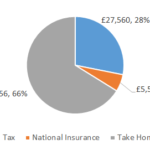

For the tax year 2019 / 2020 £100,000 after tax is £66,536 annually and it makes £5,545 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily* Gross Income £100,000.00 […]

Posted in Uncategorized

By admin on 1 July 2019

For the 2019 / 2020 tax year £99,000 after tax is £65,956 annually and it makes £5,496 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily* Gross Income £99,000.00 […]

Posted in Uncategorized

By admin on 1 July 2019

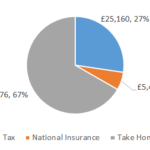

For the 2019 / 2020 tax year £98,000 after tax is £65,376 annually and it makes £5,448 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily* Gross Income £98,000.00 […]

Posted in Uncategorized

By admin on 1 July 2019

For the 2019 / 2020 tax year £92,000 after tax is £61,896 annually and it makes £5,158 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £92,000.00 […]

Posted in Uncategorized

By admin on 1 July 2019

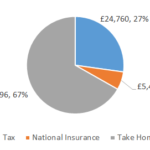

For the 2019 / 2020 tax year £91,000 after tax is £61,316 annually and it makes £5,110 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £91,000.00 […]

Posted in Uncategorized

By admin on 1 July 2019

For the 2019 / 2020 tax year £90,000 after tax is £60,736 annually and it makes £5,061 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £90,000.00 […]

Posted in Uncategorized

By admin on 20 June 2019

For the 2019 / 2020 tax year £94,000 after tax is £63,056 annually and it makes £5,255 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily* Gross Income £94,000.00 […]

Posted in Uncategorized