By admin on 6 May 2022

What You Need To Know About Minimum Wage in The UK 2022 What Is The National Minimum Wage? The current minimum wage for individuals over the age of 22 within the UK (National Living Wage) is set at £9.50 per hour, which is an increase of £0.59 from last year. The minimum for individuals aged […]

Posted in Uncategorized

By admin on 6 May 2022

The average (mean) Train and Tram Driver full time annual salary in the UK is £58,256 and the median £59,189. For men the mean full time salary of £58,466 is 5% higher than the full time mean for women £55,900. This is calculated on the basis of different levels of Train and Tram Driver jobs […]

Posted in Uncategorized

By admin on 5 May 2022

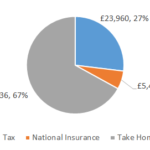

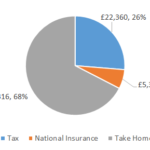

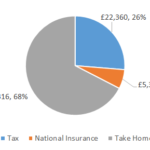

For the 2022 / 2023 tax year £89,000 after tax is £59,358 annually and it makes £4,946 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £89,000.00 […]

Posted in Uncategorized

By admin on 5 May 2022

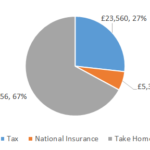

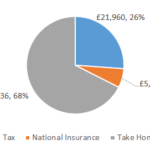

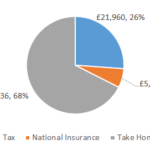

For the 2022 / 2023 tax year £88,000 after tax is £58,790 annually and it makes £4,899 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £88,000.00 […]

Posted in Uncategorized

By admin on 5 May 2022

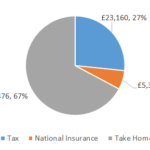

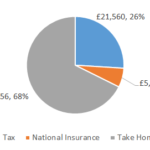

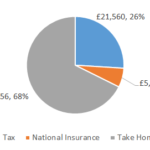

For the 2022 / 2023 tax year £87,000 after tax is £58,223 annually and it makes £4,852 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £87,000.00 […]

Posted in Uncategorized

By admin on 5 May 2022

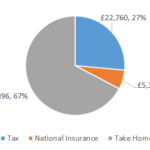

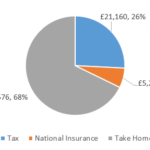

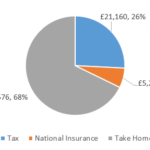

For the 2022 / 2023 tax year £86,000 after tax is £57,655 annually and it makes £4,805 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £86,000.00 […]

Posted in Uncategorized

By admin on 5 May 2022

For the 2022 / 2023 tax year £85,000 after tax is £57,088 annually and it makes £4,757 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £85,000.00 […]

Posted in Uncategorized

By admin on 5 May 2022

For the tax year 2022 / 2023 £84,000 after tax is £56,520 annually and it makes £4,710 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £84,000.00 […]

Posted in Uncategorized

By admin on 5 May 2022

For the 2022 / 2023 tax year £83,000 after tax is £55,953 annually and it makes £4,663 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £83,000.00 […]

Posted in Uncategorized

By admin on 5 May 2022

For the 2022 / 2023 tax year £82,000 after tax is £55,385 annually and it makes £4,615 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £82,000.00 […]

Posted in Uncategorized